A Montana bill of sale is a document used to confirm the transfer of ownership from the seller to the buyer. It typically includes information such as the descriptions of goods being sold, the date and location of the sale, signatures of both parties, etc.

While the Montana Motor Vehicle Division provides a bill of sale form for vehicle sales, other types of sales may require a custom bill of sale to be drafted.

It's important to ensure that all relevant information is included in the document to avoid any misunderstandings or disputes later on.

Montana Bill of Sale Parties

A bill of sale typically involves the seller and the buyer.

Seller

The seller is the individual or entity transferring ownership of the item being sold.

Buyer

The buyer is the individual who is purchasing the item.

Buyer and Seller Disclosure

To avoid potential misunderstandings, the seller should disclose all relevant information about the item the buyer plans to purchase.

The typical disclosure for the sale of a motor vehicle is the odometer reading, which indicates the number of miles the vehicle has traveled. Providing an accurate odometer reading is a legal requirement, as it helps to prevent fraud and misrepresentation in the sale of vehicles.

Including an "as is" clause in the bill of sale means that both parties acknowledge that the buyer has examined the item and agrees to purchase it in its present condition, regardless of any faults or imperfections.

This clause releases the seller from any liability for defects or issues that may arise after the sale and places the responsibility for inspecting the item solely on the buyer.

Montana Bill of Sale Description of Goods

This section includes all the relevant information about the transferred item.

It serves as the parties' official confirmation of the item's qualities and condition, which are the subject of the transaction. This helps to prevent any confusion or misrepresentations about the item's condition and ensures that both the buyer and the seller are aware of its current state.

The details entered in this section of the document will vary depending on the type of item being sold. So, be sure to describe the purchased item as precisely as possible.

Montana Bill of Sale Purchase Price

The seller and buyer have the option to agree on one of the following three payment methods:

#1. Payment

In most cases, the buyer pays the price of the purchased item in cash, by credit or debit card, checks, or via bank transfer.

#2. Trade

With this method, the buyer transfers their item to the seller in exchange for the seller's item. Additionally, if the item being traded is worth less than the seller's item, the buyer should pay a certain amount of money to make up the difference.

#3. Gift

If the item is being given to the buyer as a gift, then the seller will not receive any form of payment or compensation in return. However, the parties should include the value of the gift in the bill of sale for tax purposes.

Montana Bill of Sale for Motor Vehicles (Cars) Requirements

According to the Montana Department of Motor Vehicles (DMV) regulations, a bill of sale is not required for all vehicle transactions, but it is essential when a vehicle does not have a title.

A key element of the car-buying process is a well-written bill of sale. As a result, make sure to include all of the required components in one.

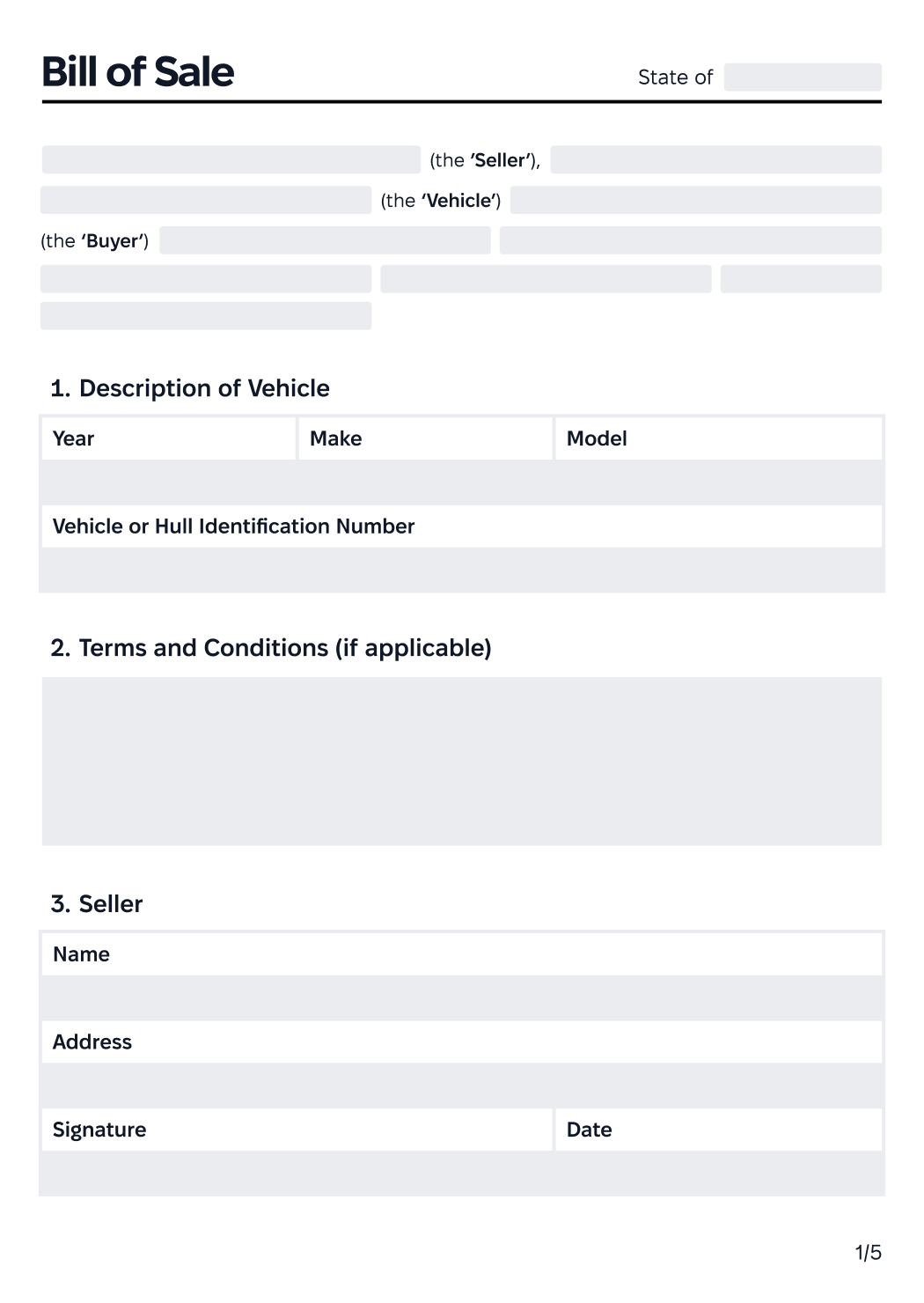

In this document, you will have to specify the purchase price, odometer reading, the vehicle's identification number (VIN), year, make, and model of the vehicle. Lastly, the signatures and addresses of both the buyer and the seller should be present to make the document legally binding.

Out-of-State Vehicles

If you purchased a vehicle that is registered in another state, provide the bill of sale as proof of purchase to ensure a smooth transaction. It is crucial to verify with the Montana Motor Vehicle Division for specific requirements and fees associated with registering out-of-state vehicles.

Abandoned or Junk Vehicles

In the case of abandoned or junk vehicles, note that such vehicles must go through the salvage title process. A salvage title is a legal document that identifies a car as a total loss as a result of damage or other circumstances.

As a result, before making a purchase, it is recommended that you verify the actual value of the vehicle and obtain a vehicle history report.

Vehicles Sold by Dealers

Dealers in Montana will provide all necessary documentation, including a bill of sale.

Vehicles Sold by Private Parties

When you purchase a vehicle from a private party, obtaining a bill of sale that includes the vehicle's VIN, purchase price, and signatures of both the buyer and the seller is essential.

This serves as a receipt for the transaction and ensures that you have all the necessary documentation to register the vehicle in Montana.

Montana Bill of Sale for Boats (Vessel) Requirements

In Montana, a bill of sale is a legal document used to transfer ownership of a boat (vessel) from one party to another. It should include the following information:

Mandatory Information

The date of the sale

Names and contact information of the buyer and seller and their signatures

Vessel's make, model, and year

Vessel's identification number (Hull ID or VIN)

Purchase price

Montana Bill of Sale for Firearms Requirements

In Montana, a bill of sale is not required for private sales of firearms. However, both the buyer and the seller should retain a copy of the bill of sale as a record of the transaction. The bill of sale for firearms should contain the following:

Mandatory Information

Names, addresses, and phone numbers of both the buyer and the seller

Make, model, and serial number of the firearm

Purchase price

Date of sale

Montana Bill of Sale for Horses Requirements

For the purchase of horses or livestock in Montana, note that a bill of sale is required to prove ownership. This document should contain an accurate description of the horse or livestock, including its breed, age, and gender.

You should present the bill of sale to the livestock inspector whenever the transfer of ownership occurs. This ensures that the animal is disease-free and that the transfer of ownership is properly documented.

Montana Bill of Sale for Trailers (RVs) Requirements

Trailers and other recreational trailers must be registered in Montana.

When buying or selling a trailer, it is important to obtain a bill of sale that provides a detailed description of the trailer and its price.

Montana Bill of Sale Other Requirements

The parties are free to draft the bill of sale in any language they're both fluent in. However, the bill of sale must be filled out in English to be considered legally valid in court or by state authorities.

As the bill of sale acts as evidence of the transaction, it is advisable for both the seller and buyer to retain a copy of the document for their personal records.

Montana Bill of Sale Taxes

Montana, as governed by the Montana Department of Revenue, does not impose a general sales tax on goods. However, certain counties within Montana may impose their own sales taxes, which can vary.

As a result, it is important to be aware of the specific tax laws applicable to the county in which you operate or conduct business.

A handwritten bill of sale is legitimate if it contains all the information required by Montana law.

The bill of sale should be signed by both the buyer and the seller. For further validation, the parties may choose to have the bill of sale signed by a witness or notarized.

You can write your own bill of sale or download one of our professional bill of sale templates for each type of transaction.

A bill of sale is a document that is mutually beneficial. On the one hand, the buyer has proof of payment and transferred ownership, while on the other hand, the seller cannot be held legally liable if they accurately disclosed the item's condition.