A Minnesota bill of sale is a legal document that records the transfer of goods from one person to another. It generally includes information about the seller and buyer, the purchased goods, and the price.

By having a bill of sale, the buyer proves ownership of the goods, while the seller has written confirmation that they have sold the goods and are no longer responsible for them.

In addition to serving as proof of ownership, a bill of sale can also be used for tax purposes as it provides evidence of the purchase price.

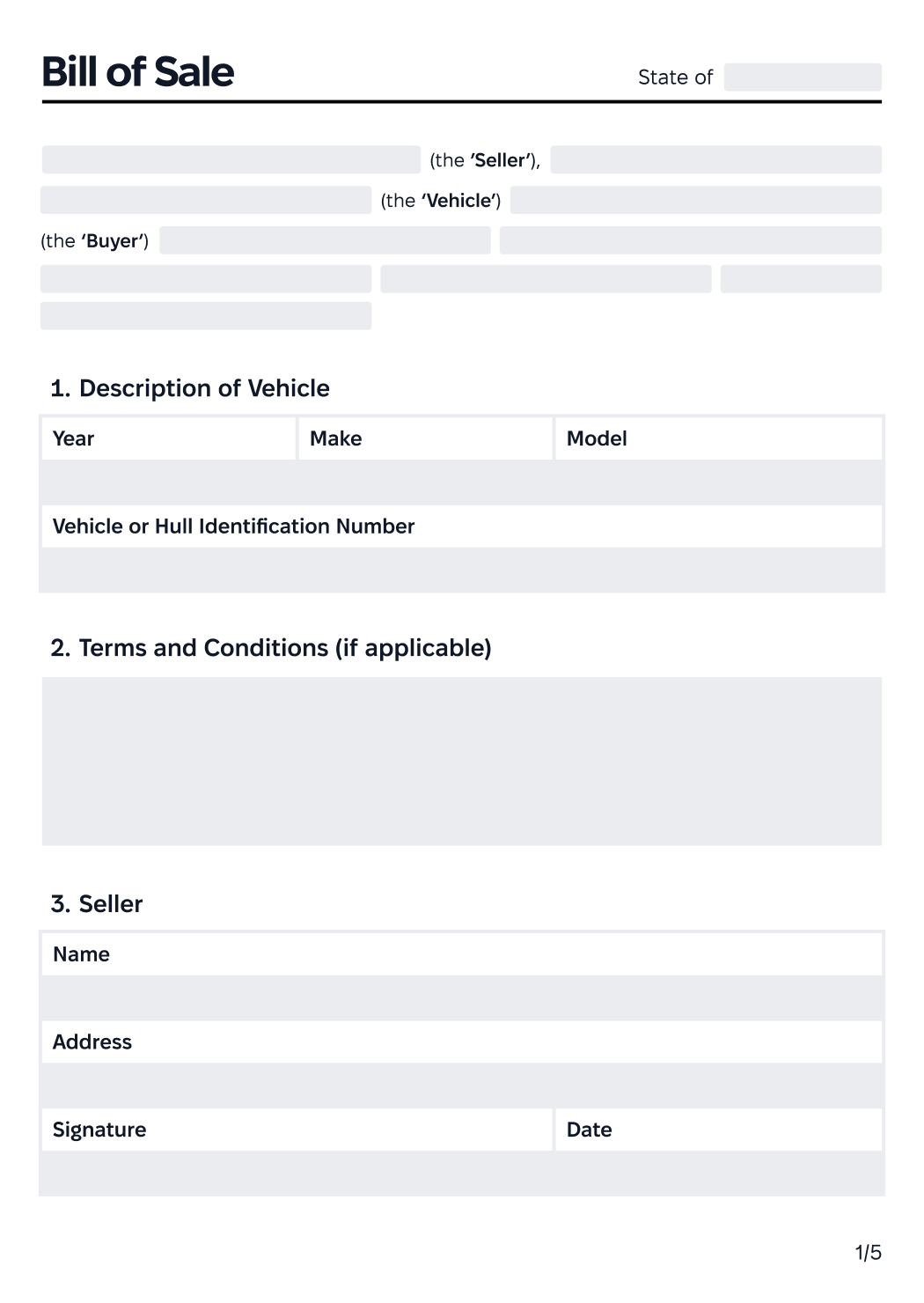

Minnesota Bill of Sale Parties

The parties in a bill of sale are the buyer and the seller. In addition to them, a bill of sale can include other parties, such as a witness or a notary public.

Seller

The seller can be a private party or a legal entity. The seller's section should include identity and contact information and clearly state the seller's obligation to deliver the goods to the buyer.

Buyer

Likewise, the buyer's identity and contact information should be clearly identified. The buyer's acceptance of the goods should also be stated on the bill of sale.

Buyer and Seller Disclosure

A bill of sale usually includes certain disclosures that are important for both the buyer and seller to be aware of. The most common are:

Mandatory Disclosures

The odometer reading reveals the total mileage that the vehicle has traveled. This information is important for the buyer, as it can affect the value and condition of the vehicle and impact the cost of future maintenance and repairs.

The "as-is" statement indicates that the item is being sold in its current condition without any warranties or guarantees. This is a common disclosure when selling used items.

Minnesota Bill of Sale Description of Goods

An essential part of any bill of sale is a detailed description of the item being sold.

In this section, you should include identifying information such as serial numbers or unique identifiers (e.g., the make and model of the item, its size or dimensions, and any accessories or components included in the sale).

It is also important to provide a clear and accurate description of the item's condition. Whether the item is new or used, it's important to be transparent about any known defects or issues that may affect its value or performance.

Minnesota Bill of Sale Purchase Price

The main obligation of the buyer is to compensate the seller for the sold item, and they can do it in three ways.

#1. Payment

With this method, the buyer transfers a certain amount of money to the seller in exchange for the purchased item. They can do this by handing over cash, using a credit or debit card, or via a bank account.

#2. Trade

During the trade, the buyer transfers an item they own to the seller as a form of compensation for the purchased item. If the value of the item the buyer is transferring is lower than the value of the item purchased, the buyer pays the difference in cash to make up for the full price.

#3. Gift

In a situation where the seller transfers an item to the buyer as a gift, the buyer does not pay any compensation to the seller for the gift. However, it is recommended that both parties specify the value of the gift in the bill of sale for mutual safety.

Minnesota Bill of Sale for Motor Vehicles (Cars) Requirements

While it's not mandatory in Minnesota, both seller and the buyer should have a bill of sale when buying or selling a vehicle for record-keeping purposes.

In that case, the parties should include the following information:

Mandatory Information

Names and addresses of the seller and buyer

Vehicle make, model, and year of production

Vehicle identification number (VIN)

Odometer reading at the time of sale

Purchase price

Date of sale

Signature of both the seller and the buyer

However, vehicles such as cars, trucks, motorcycles, buses, vans, and large trailers must have a title in Minnesota. In most cases, the transfer of ownership should be done on the title certificate within ten days of the sale, unless there are unique circumstances.

Out-of-State Vehicles

When buying a vehicle outside of Minnesota, the buyer and seller should create a bill of sale that includes the aforementioned elements to protect their rights and interests and prevent potential misunderstandings.

Abandoned or Junk Vehicles

A bill of sale is not mandatory for salvage vehicles in Minnesota, as the state doesn't require it for vehicle title transfers.

Vehicles Sold by Dealers

When purchasing a vehicle from a dealer, it's common for them to handle the title acquisition process for the buyer. But even in this case, the buyer and seller should still make a bill of sale and include information about the vehicle.

Vehicles Sold by Private Parties

Similar to previous scenarios, private individuals who are buying or selling a vehicle are not obligated to provide a bill of sale in Minnesota. However, it's recommended that they document the transaction.

Minnesota Bill of Sale for Boats (Vessel) Requirements

For the purchase of a boats, sailboats, or other vessels in Minnesota, the seller and buyer should include the following information in the bill of sale:

Mandatory Information

Names, addresses, and contact information of the buyer and seller

Year, make, model, and length

Hull identification number

Description of the vessel condition

Damage and flaws disclosures

Odometer readings

Sale price and date

Signatures of buyer and seller

Minnesota Bill of Sale for Firearms Requirements

In Minnesota, there is no legal requirement for firearms buyers to register their purchases.

However, given the nature of the item, it's crucial for both the seller and buyer to document the transaction by providing their information in a bill of sale and including all pertinent details about the weapon.

Minnesota Bill of Sale for Horses Requirements

Due to the high value of horses, a bill of sale should be used to record the transaction. It should include the following:

Mandatory Information

Information about the seller and the buyer

Horse name, breed, age, and gender

Disclosure of any defects or diseases

Purchase price

Signatures of the seller and buyer

Minnesota Bill of Sale for Trailers (RVs) Requirements

Minnesota law does not require a bill of sale when purchasing a trailer.

Minnesota Bill of Sale Other Requirements

While there is no language mandate for legal documents in Minnesota, it's advisable to use English or provide an English translation. Otherwise, the parties are free to use any language they understand.

Additionally, the seller and buyer should each keep one copy for their personal records.

Minnesota Bill of Sale Taxes

Taxes on purchases are imposed in the state of Minnesota. The Minnesota Department of Revenue provides a list of taxable sales to help both buyers and sellers navigate the process.

Minnesota Bill of Sale FAQ

A handwritten bill of sale in Minnesota can be legally binding as long as it contains the essential elements and the signatures of the seller and the buyer.

Both the seller and buyer should sign the bill of sale.

You can either compose a bill of sale yourself or download reliable and professional templates for every occasion from our website and save time.

The bill of sale provides benefits for both the seller and the buyer. For the seller, it limits their liability for the item once it has been transferred to the buyer. The buyer, on the other hand, can use the bill of sale as proof of transferring ownership over a purchased item.