The Arkansas bill of sale is the legal document for recording the transfer of ownership and rights over personal property. It is mostly used to record motor vehicle sales but can also be used for transferring ownership of guns, animals, or furniture.

Most states require a bill of sale for transfers of motor vehicles and branded animals like horses. Usually, the state DMV requires the bill of sale for the vehicle's registration.

The bill of sale is usually drafted by the seller, signed by both parties, and, in some states, notarized. Therefore, check the local laws and regulations to see if the bill of sale must be signed by both parties and notarized in your state.

Arkansas Bill of Sale Parties

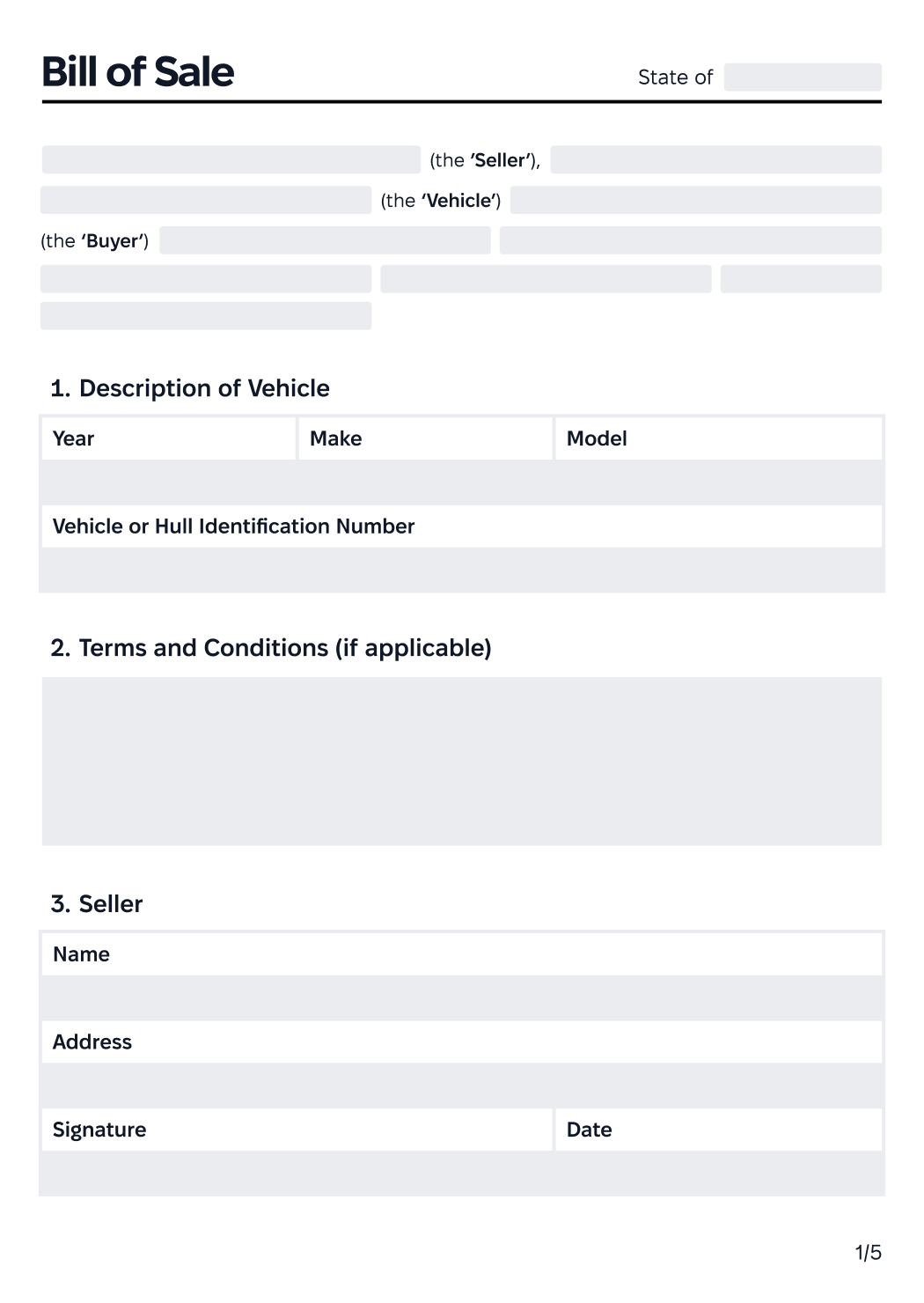

The main parties to the bill of sale are the buyer and the seller. Arkansas bill of sale should contain the basic information about the buyer and the seller, such as their name, address, and phone number.

Seller

A seller is a person who transfers ownership of a certain item in exchange for the purchase price. There can be more than one seller, and they can also be referred to as the transferor.

Buyer

This is the person to whom ownership of a certain item is being transferred. They can be mentioned in the bill of sale as the transferee, and there can also be more than one buyer listed in the bill of sale.

Buyer And Seller Disclosure

The seller must make an odometer disclosure when selling a motor vehicle.

The bill of sale can also contain the “as-is” condition, meaning that the buyer agrees to buy the item in its current state with all the damages and flaws. This will prevent the seller’s liability for any later flaws unless they are hidden or lied about.

Arkansas Bill of Sale Description of Goods

This section should contain a description of the item that is being transferred. Different information can be included in the property description based on the type of item that is transferred.

In general, the item that is being transferred should have all the information that can be used to identify it. The description shall include the registration number of the item, if applicable.

For car purchases, the description shall include the following information:

Mandatory Information

Vehicle make and model

Body type and color

Year of production of the vehicle

Vehicle identification number (VIN)

Odometer reading

A description shall also highlight any damages or flaws that the item has. Together, the "as is" disclaimer and the item's description will protect the seller from any claims about the item's condition.

Arkansas Bill of Sale Purchase Price

Check out the most common methods of transferring the item and the purchase price in the section below.

#1. Payment

This is the most common way of purchasing an item. The parties will enter the amount of money the buyer will pay the seller. The payment method can also be specified in the bill of sale (cash, credit card, checks).

#2. Trade

With this method, the buyer provides their own item as part of the transaction. The value of the buyer's item shall also be provided in the bill of sale. As a result, the buyer can exchange their item for the seller's item or offer an item and additional payment in exchange for the item.

#3. Gift

When an item is transferred as a gift, no counter value is transferred to the seller. However, the parties shall record the estimated price of the transferred item for tax and accounting purposes.

Arkansas Bill of Sale for Motor Vehicles (Cars) Requirements

The Arkansas Code regulates the procedure for motor vehicle registration and provides certain rules regarding the bill of sale for motor vehicle transfers.

Out-of-State Vehicles

Unlike Ohio and South Dakota, Arkansas does not require a bill of sale to register a vehicle purchased in another state.

Abandoned or Junk Vehicles

In Arkansas, the bill of sale can also include junk and salvage vehicles.

Vehicles Sold by Dealers

Arkansas does not require a bill of sale for cars bought from dealers. However, many car dealerships will provide the bill of sale as proof of the transaction.

Vehicles Sold by Private Parties

Arkansas law requires the bill of sale in case there is no room on the title for the seller's signature or if the seller would like to apply for the sales tax credit.

Arkansas Bill of Sale for Boats (Vessel) Requirements

The bill of sale for the vessel should include the following elements:

Mandatory Information

Details and signatures of the buyer and the seller

The make, model, and year of the vessel

The hull identification number (HIN)

A vessel description

The selling price

Signature place and date

Additionally, the bill of sale should include a warning about perjury as defined in the Arkansas Code and the consequences for providing false information in the bill of sale for sales tax credit purposes.

Arkansas Bill of Sale for Firearms Requirements

The Arkansas bill of sale for the firearm purchase should contain the following:

Mandatory Information

Names and addresses of the buyer and the seller

The firearm make, model, and caliber

Serial number

Description of any defects (if present)

Purchase price

Arkansas Bill of Sale for Horses Requirements

The law doesn’t require a bill of sale for transferring ownership of the horse in Arkansas. However, many choose to draft one to have a record of the ownership transfer.

Arkansas Bill of Sale for Trailers (RVs) Requirements

The Arkansas bill of sale for any kind of recreational vehicle should include the following:

Mandatory Details

Details about the buyer and the seller

Make, model, year, and length of the RV

Vehicle identification number (VIN)

Odometer disclosure

Description of any additional equipment that comes with the RV

Disclosure of any damages to the RV

Arkansas Bill of Sale Other Requirements

Regardless of your bill of sale type, you should ensure your Arkansas bill of sale fulfills the language requirements.

This means you can draft the bill of sale in any language as long as both the buyer and the seller understand it. However, when registering the vehicle, the DMV will require all the documents to be in English. So make sure you provide the official translation of your bill of sale in English.

In addition, make sure both the buyer and the seller have at least one copy of the bill of sale and make at least one additional copy that can be submitted to the Arkansas DMV for the vehicle registration.

You should check with the Arkansas DMV if there are any additional requirements for the bill of sale when registering a vehicle.

Arkansas Bill of Sale Taxes

The bill of sale is required in Arkansas if the seller wants to apply for the sales tax credit.

Also, the bill of sale shall include a warning about the consequences of false purchase price reporting for tax purposes.

Arkansas Bill of Sale FAQ

Yes, the Arkansas bill of sale can also be handwritten as long as it contains all the necessary elements.

For the Arkansas bill of sale to be valid, it must be signed by both the buyer and the seller.

The best way to get a professional bill of sale for any type of item transfer in Arkansas is to download one of the templates available on our website.

Both the buyer and the seller can benefit from the bill of sale since it provides proof of the translation and ownership transfer for both parties.

Additionally, it prevents any future disputes about the condition of the transferred item as long as all the damages are properly disclosed in the bill of sale.